Mobile Deposit is now available. You will be able to deposit checks through your mobile device. We are excited to offer this to our members as another convenient service from your Credit Union. Please review our frequently asked questions below to see how this new service works.

What is Mobile Deposit?

Mobile Deposit is a remote deposit service that allows you to make check deposits into your Share Account, from the convenience of your home or other remote locations, using your mobile device. Original checks are scanned and the digital image is delivered to First Choice America Community Federal Credit Union. Upon receipt of an image, it will be reviewed for acceptability.

How do I access the Mobile Deposit service?

To access Mobile Deposit, you must first enroll in First Choice America’s online internet banking service. After enrolling in internet banking, you will need to obtain the First Choice America Mobile App for your mobile device. The option for mobile deposit is located within the Mobile App.

What type of checks may be deposited using Mobile Deposit?

We generally accept checks drawn on U.S. Banks and payable to you. There is a list of checks that are not eligible for deposit through Mobile Deposit, such as Cashier’s checks, US Treasury checks, money orders, savings bonds, etc. A complete list of ineligible items is found in the Mobile Remote Deposit Terms and Conditions Agreement on the Mobile Banking App. It can also be found on our website.

What is the best way to capture a check image?

To obtain a clear and acceptable image, please place the check on a dark background before taking the photo. Take the photo in a well-lit area and avoid shadows across the check. Keep your phone flat and steady above the check when taking the photo and be sure to include the entire check in the photo frame.

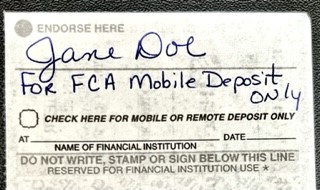

How must the check be endorsed to be accepted for deposit?

Original checks must be properly endorsed by you. Endorsements must be made on the back of the check and must include your signature AND the words “FOR FCA MOBILE DEPOSIT ONLY”. It is also best practice to include your account number.

Checks payable to two payees must be endorsed by both payees. All payees on a check must also be account holders.

Are there limits to the amount that may be deposited through Mobile Deposit?

There is a daily dollar limit of $1,000.

When will funds be available if deposited using Mobile Deposit?

The first $275 of the funds deposited using the service will generally be made available the next business day after the day of the deposit. The remaining funds will generally be made available no later than two business days from the day of the deposit. The Credit Union, in its sole discretion, may extend the hold period beyond two business days for various reasons described in the Terms & Conditions. If the availability of funds exceeds two days, you will receive a notice advising you of the day funds will be made available.

Is there a cut-off time for making Mobile Deposits?

Image item deposits initiated through the system before 2:00pm ET on a business day, are posted to the member’s account the same day, subject to funds availability. In the event that we receive an image item from you after 2:00pm ET, or on a day that is not a business day, the image item is considered as received by us at the opening of the next business day. For the Mobile Deposit program, a business day is described as Monday through Friday, except for Federal holidays.

What happens to the original check?

You must safely store the original check for 30 days once you have confirmation that the deposit was accepted. After 30 days, the original check must be shredded.

Please refer to the following link: Mobile Remote Deposit Terms and Conditions Agreement for more terms and conditions governing Mobile Deposit. You may reach us by telephone at 304-748-8600 or inquire in person at one of our eight locations.